Planning for 2024 and Beyond: A New Bull Market or Financial Storms Ahead?

2023 is in the rearview mirror. It was a memorable year. We started off strong, had three major bank failures, interest rates spiked, we endured a 10% correction and ended the year with a massive rally to the upside. Almost every asset class, with the exception of bonds, was up double digits to end the year.

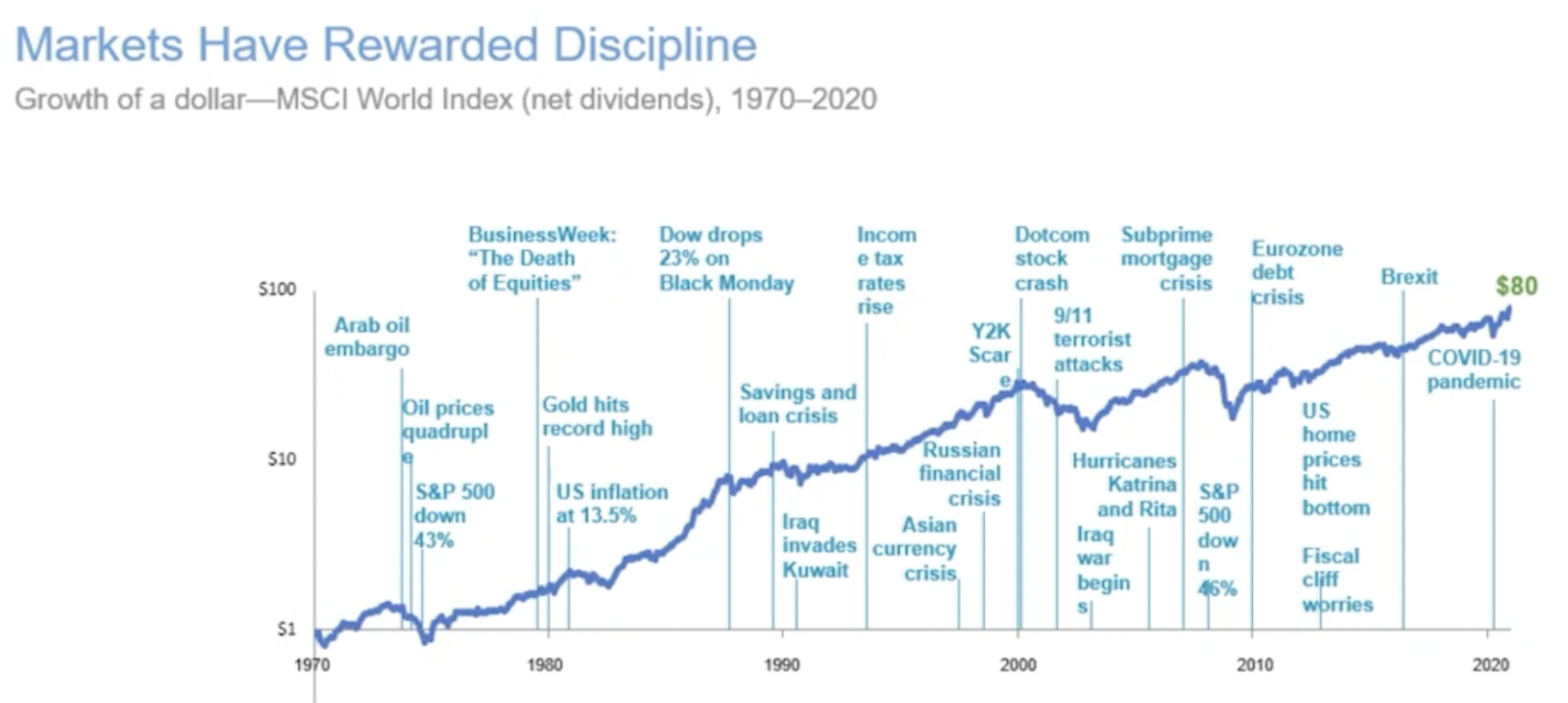

What are some of the takeaways from last year? The big ones are that patience and risk taking are rewarded. Most investors waited out the risk on the sidelines because they were excited to finally earn a higher interest rate from their savings accounts.

Currently, a record breaking $6 trillion in cash is on the sidelines. I get it. The 4% guaranteed yield is an attractive reason to avoid a stock market that was down 20% just a year ago.

Why invest in stocks when you can get a guaranteed 4%? The reason is that there is a major opportunity cost to staying in cash. You earn 4% but forego the long-term gains of the market which has returned over 9% historically. Last year was a good example of this. If you stuck long-term dollars in a money market then you got 4% but you also missed out on double digit portfolio growth.

Pros/Cons of Cash

Let’s start with the big drawback of cash. Say you are in a marginal tax bracket of 32%. You will have to pay about 1/3rd of your money market yield back in taxes so you actually have an after-tax return of 3%. What is the current inflation rate you may ask? The government is reporting it at 3.4%.

Congratulations, this means your purchasing power remained completely unchanged for the year and you were essentially running in place.

What are the advantages of holding cash? Cash offers unparalleled flexibility, allowing you to make purchases or investments at your convenience. It also can provide peace of mind, particularly if short-term market fluctuations concern you.

However, it's important to recognize that this benefit comes with some major trade-offs.

Even if you are an aggressive investor, it is still a good idea to maintain a cash reserve of three to six months' living expenses. Think of this as an insurance policy. Additionally, you should set aside sufficient funds for significant expenditures beyond your regular cash flow over the next couple of years.

Streamline Decision Making

The best investors in the world don’t worry about day to day volatility. They simply invest their excess savings in something productive. This doesn’t mean you have to only invest in the stock market. There are a lot of different ways you can invest your funds. You can save up for a rental property, add an ADU to your property or even buy a small turnkey business.

However, these things take time and effort so you may be better off just investing the funds if you aren’t excited about taking on additional work or unknown risk.

The best approach is to figure out how much excess cash you have available each month and then automate the investing. You can do this by setting up a monthly transfer from your bank account to your investment account.

This may seem straightforward or obvious, yet it really can make a huge difference over time. This is one of the great features of the 401k. You set it up one time, allocate a percentage of your income to it and then years later you wake up with a big pile of money.

What if you simply don’t want to put more money in the market? If you're hesitant to invest more in the market and prefer maintaining a substantial cash position, now might be an opportune moment to secure a higher interest rate with a Certificate of Deposit (CD).

Of course, this is a distant second best option to investing. If you prefer to stick with your high yield Marcus, Ally or Synchrony account then a CD may help you lock in a higher rate for a period of 1 to 5 years. The drawback of a CD, aside from taxes and opportunity cost, is that you may have to pay a penalty if you withdraw the funds before the maturity date.

The Year Ahead

My take on interest rates is that they will fall faster than everyone is expecting. The government reported rate of inflation is now at 3% which is a huge improvement from a year ago when inflation was printing 7%. My view is that the Fed hiked rates way too fast and they will probably have to cut rates just as quickly to keep the economy from going into the toilet. The market is already pricing in 5 rate cuts in 2024.

Truflation, a data aggregator that uses more up to date inflation numbers, is now showing inflation at 1.76% year-over-year. This indicator has been fairly accurate over time but typically lags the backward looking data the government uses to comprise current inflation.

Why does this matter? Remember earlier when I said there is a record $6 trillion of cash on the sidelines? When interest rates start to drop there is a good chance that a meaningful portion of cash on the sidelines will look for a new home in the market which would be a major tailwind for equities.

Election Year 2024

Should we be worried about the election year? It now appears that Lord Voldemort, I mean Donald Trump, may actually have a decent shot at winning back the presidency. Won’t this tank the market and especially all of the sustainable investments? The market doesn’t really care about the president. Of course, if we have a situation where the republic ceases to exist then all bets are off. However, we probably won’t be worrying too much about the stock market if we are facing a government collapse.

Historical data shows that stocks are actually more positive in election years. The market is positive 83% of election years versus only 63% of non election years. Typically the incumbent will do what ever they can to make sure the economy is firing on all cylinders.

Up = Down

What about sustainable investing? Won’t fossil fuel energy, big tobacco and weapons manufacturers outperform if Trump gets re-elected?

It’s kind of ironic but the fossil fuel energy companies actually performed worse over the Trump presidency than Biden’s so far. The publicly traded fossil fuel energy sector ETF, XLE, was actually flat for four years during Trump’s presidency. The sector has shot up by 33% since Biden took office.

Impact Investing is for the Long Run

The same is true for the solar energy index ETF, TAN. It performed much better from 2016 to 2020 and has underperformed over the past three years relative to market benchmarks.

There are just too many exogenous factors at play in the global economy that supersede any influence a president has on the economy.

The government can play a major role in helping to transition the world to cleaner energy sources by using incentives and taxing externalities like carbon emissions.

The Inflation Reduction Act that Biden signed into law was the biggest climate bill ever enacted. This was a huge down payment on clean energy solutions that we are actively owning in the portfolio.

However, even after the historic bill was passed, this area of the portfolio has greatly underperformed due to rising interest rates over the past year. Most of these initiatives will benefit clean energy companies over the long-term. The market tends to care about the next quarter not the next decade.

Expect to Lose Money

What should you expect for the next year? If you are in an aggressive portfolio with mostly stocks then you should expect your portfolio to go down by 10% at some point over the next 12 months. Market corrections happen on average once every two years. These can be painful but they can also be a great opportunity to put more cash to work and essentially buy stocks at a discount.

Remember, volatility is the price of admission to earning higher long-term returns.

What Should You Focus On?

When it comes to the markets, presidential elections and climate change it can be easy to internalize stress that you have almost no control over.

In closing, I will leave you with one of my favorite illustrations and some sage advice from Carl Richards of the Behavior Gap.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.