Are We There Yet?

Recently my family drove five hours to Mammoth for a ski trip during our kids’ spring break. My wife and I have two daughters, ages five and eight. Predictably, a mere 10 minutes into the trip, we get the first of many questions: “How many more minutes?”

This is relatable because I remember asking my parents the same question as a kid on long road trips from Pittsburgh to the Jersey Shore. When you are a five-year-old, every minute can seem like an eternity, especially when you only have a vague concept of distance and time.

Right now, I feel like the five-year-old in the car on a long trip asking “when is the market going to recover? Are we almost there yet? How many more days until the Fed cuts rates?”

The short answer is that I have no idea because the market charts new historical ground every year. The long answer is that we are likely closer to the end of the market turmoil if we compare our current malaise to past downturns.

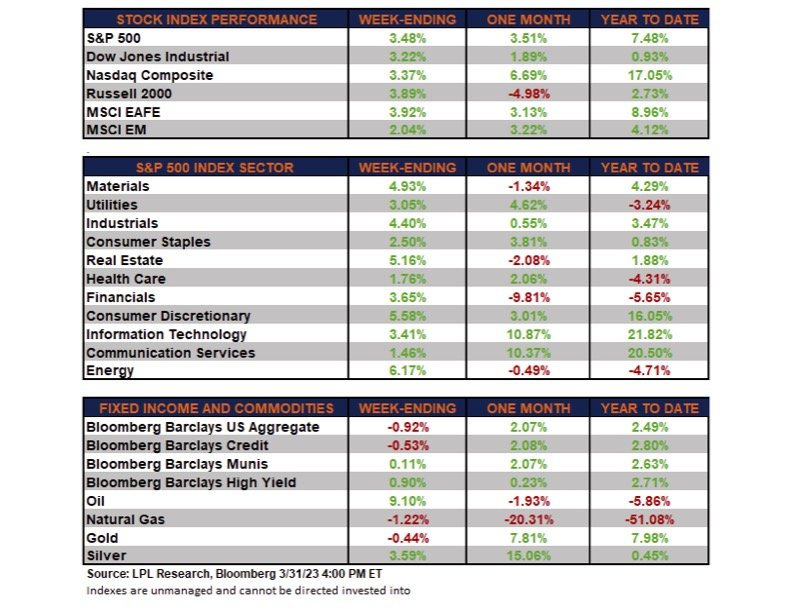

Surprisingly the market has shrugged off all of the scary headlines over the past few months and is actually positive year-to-date returning over 7% since the beginning of the year.

The S&P 500 reached a market high of 4796.56 on January 3, 2022. As of today’s stock market close, we are still down about 15% from the peak. High inflation has been one of the main drivers of the weak performance over the past year.

The Federal Reserve, which seemed to be asleep at the wheel in 2021, abruptly woke up in 2022 and hiked interest rates faster than ever before in history. We saw the federal funds rate go from .25% to 5% in a single year.

The market is now pricing in a federal funds rate cut by the end of the year. It appears that inflation is starting to subside and we are moving closer towards the federal funds target of 2% inflation.

A popular sentiment on Wall Street over the past year is that the Fed is going to hike rates until they break something. Apparently, that something was Silicon Valley Bank.

Two weeks ago, which now seems like two years, the 16th largest bank in the US collapsed as customers tried to withdraw their deposits within a couple of days.

What caused the run on the bank? It was due to several factors. One is that the bank had largely mismanaged its duration risk. The bank used short-term deposits from customers to buy long-dated treasuries in a search for higher yields and bigger profits.

The problem is that when interest rates increase, the price of existing bonds will go down in proportion to the bond duration or time until the bond matures. Longer-dated bonds are much more interest rate sensitive than shorter-dated bonds.

Add to the mix that Silicon Valley Bank was primarily serving venture capital-backed startup companies that have been drawing down deposits. In 2020 and 2021, the venture capital-led startup world was on fire. Startups were raising record amounts of capital as low interest rates led to a frenzy of speculative risk-taking.

Fast forward to 2022 and the venture capital party abruptly came to an end. The ensuing hangover meant that fresh funding had almost completely dried up. The non-profitable startup companies then began to draw down the capital they raised in the boom years of 2020/21.

The mix of declining deposits, excessive risk-taking by the bank and a spike in interest rates was the perfect storm that basically made Silicon Valley Bank insolvent.

Fortunately, the Federal Reserve along with the Treasury Secretary stabilized the banking situation by guaranteeing all customer deposits. However, this created a massive amount of volatility, especially in regional banks, as everyone looked at each other and asked, “Who is next?”

Stop Worrying About Environmental, Social and Governance Factors! (ESG)

In other investment news, the United States Congress has finally solved all of the problems facing the US. Since it has so much time on its hands, it will now tell retirement plan fiduciaries how to best invest money.

No, but seriously, Congress passed a law prohibiting money managers of public funds from considering environmental, social and governance (ESG) factors when evaluating investments. Fortunately, President Biden issued his first veto overturning the law.

Impact Fiduciary was recently featured in an InvestmentNews article discussing these events. My view is that ESG factors should be considered not only because they incentivize positive actions but because they can have a direct impact on risk and performance.

Don’t Throw Out the Baby with the Bath Water

Source: Ethos ESG rating of Tesla

Just like anything else, ESG investing isn’t perfect. One of the problems is a lack of standardization across the organizations providing ESG ratings. A company can have a great score from one ESG provider and a terrible one from another.

This is an issue that I’ve written about over the years and one of the reasons that ESG is just one aspect of our sustainable investment framework.

Impact Fiduciary takes what we believe to be a common-sense approach to sustainable investing. We use a three-pronged process when evaluating companies and funds:

Socially Responsible Investing – We avoid certain areas of the market (fossil fuel sector, weapons, tobacco, authoritarian countries, social media, private prisons, factory farms, fast food and health insurance companies).

ESG – We then evaluate the ESG scores from at least two score providers while going with the highest score (All else being equal).

Impact Investing – Approximately 15% of the portfolio is invested in companies directly tied to solving the climate crisis and affecting positive outcomes in the world. This includes investments in solar, wind, battery storage and alternative energy companies.

It’s no secret that Congress works for lobbyists, not the American people. Lobbies supporting fossil fuel, tobacco, gun companies, fast food and private prisons all have an incentive to squash the ESG movement. In some ways, this just shows that the ESG movement is working and gaining steam.

Source: Shutterstock

The reality is that this bill will likely come back once the next administration changes parties. In fact, there were even a few democrats who supported the bill.

Coincidentally, these democrats hail from states where the fossil fuel sector is a large part of their economy. They have a huge incentive to keep the share prices of fossil fuel companies artificially inflated for as long as possible.

The Trump-era law that was overturned stated that you could be breaking your fiduciary duty if you consider anything other than returns. However, we believe that a money manager has the right to consider ESG factors as it can lead to funds with better performance and less risk.

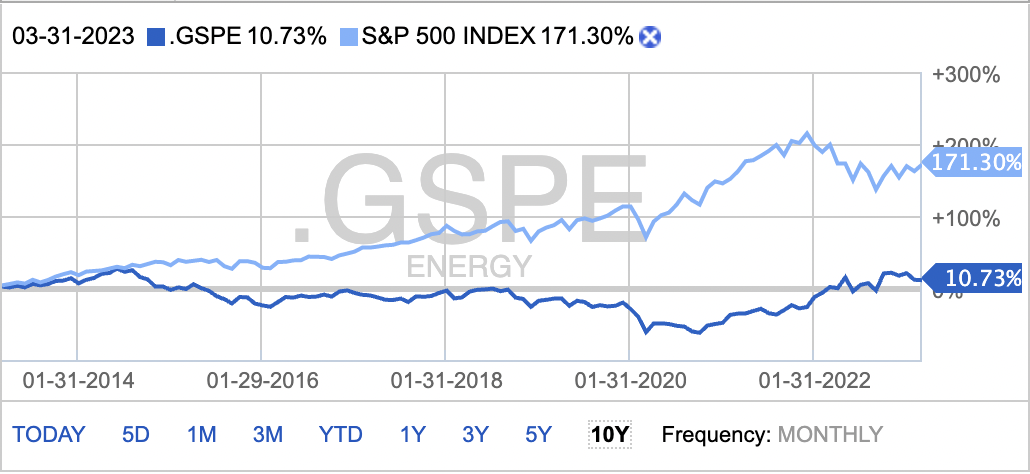

There is direct evidence to support this claim. If you are investing in retirement funds, then you are probably in it for the long haul. Well, what sector has performed the worst over the past decade? The fossil fuel energy sector.

Over the past ten years the S&P 500 enjoyed a cumulative return of 171.3% versus the fossil fuel energy sector’s return of a dismal 10%! That’s an average of 1% per year. Investing in the energy sector has been a major drag on performance over the long-term.

I’ve found that the most consistent and discernible difference between ESG and non-ESG funds is the delta in exposure to the fossil fuel energy sector. ESG funds typically have little or no exposure to the fossil fuel energy sector.

Source: Fidelity Investments

We’ve all seen the recent reports from the IPCC showing that we are running out of time. We all need to figure out how we can help speed up the transition to clean energy.

One way is to stop supporting the companies most responsible for climate change with your investment dollars.

Instead, investing that money in companies that are part of the solution can help speed up the timeline to a truly sustainable economy.

Just like the five year old in me, I’m wondering “How much longer until we get there?”

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.