Investing in a Better Future in 2023

2022 was not a fun year for the equity and bond markets. They both finished one of their worst years on record. Today we’ll dive into the past year and discuss why the recent downturn shouldn’t really matter to most investors.

Everyone rang in 2022 with an optimistic outlook for the markets, but fast forward to December 31st and the S&P 500 lost almost 20%, while the tech heavy Nasdaq index declined by 33% for the year. The bond market fell 13% in tandem with equities, which is very unusual from a historical perspective.

The bond market is supposed to be a boring and predictable safe haven; not so much in 2022. Rising interest rates pummeled the value of bonds, making it the worst year for fixed income recorded in recent history.

Unfortunately for the planet, the only sector that performed well was fossil fuel energy, which went up by 59%.

Everything is More Expensive

The main culprit for the decline last year was inflation. The Federal Reserve mistakenly believed that inflation was transitory in 2021, which resulted in keeping rates way too low for way too long.

This resulted in high inflation, rampant speculation, and distorted asset prices across the board. Remember people buying and selling $30,000 JPEGS of bored apes called NFTs and Matt Damon hawking crypto? This didn’t work out so well.

In 2022, the party abruptly came to an end as the Fed changed course by aggressively hiking rates. In fact, the Federal Reserve has never hiked rates this quickly.

The good news is that most of the recent economic reports indicate that inflation has likely settled.

Is ‘23 The Year of the Bull?

2023 is off to a good start and it’s possible we are in the early stages of an expanding market.

Of course, predicting the future is very hard because you are, well, predicting the future. Only fortune tellers and time travelers can tell you with any certainty what to expect. With that said, there are reasons to be optimistic.

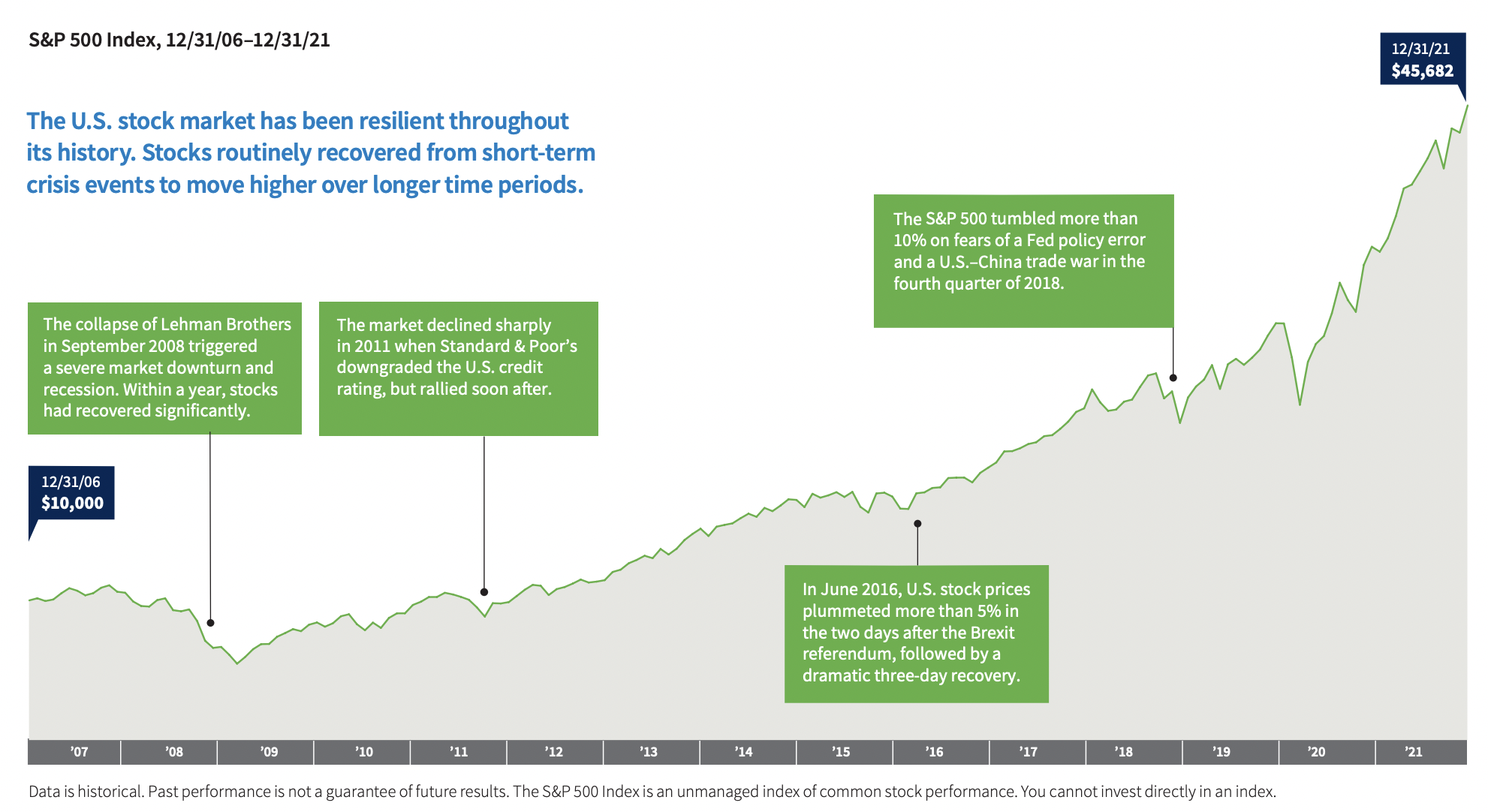

As you can see in the chart above, when the market does rebound, it does so sharply.

Buy High, Sell Low

Most “investors,” and especially the retail public, like to sell at the bottom and buy at the top. I’ve found that most of my clients don’t necessarily sell but like sit on the sidelines instead of putting more cash to work in down markets. Warren Buffett famously said that, “it is wise for investors to be fearful when others are greedy and greedy when others are fearful.

Source: Putnam Investments

Time in the Market, Not Timing the Market

As you can see in the graph above, bear markets and corrections shouldn’t matter as long as you are investing for the long-run and can keep a long-term perspective. Even your entry point into the market doesn’t make that much of a difference if you have a well diversified portfolio and time on your side.

However, the reality is that people are emotional, and it can be tough staying on course or putting money to work when it seems like your hard-earned cash is going into an incinerator.

One way to think about volatility and short-term losses is that it is the price of admission for higher returns over the long run. The stock market has historically averaged about 10% a year. However, it doesn’t go up in straight line.

In Systems We Trust

So what is the solution? I’ve worked in the financial services industry for the past 17 years. Over the years I’ve found that the best way to build real wealth in the market is to systematically put money to work in both up and down markets. This is one of the reasons why I love the 401k plan. You only need to make a few decisions (hopefully good ones), and 20 years later you wake up with a nice retirement.

I get it. Investing outside of a 401k can be a little trickier because you constantly have to make the decision to put money to work against competing interests. Do I want to spend my excess savings on a new renovation or take that vacation to Europe? Should I buy a luxury car or a used car? Should I only sustain myself on caviar?

If you do make the smart decision to save or invest, then the questions become where, when, and how. Do I want to just sock it away in a high-yield savings account so I don’t have to worry about the volatility? Should I just wait until things calm down, then put money to work? Am I investing in sustainable companies that are solving problems or causing them?

These are the tricky questions that we can help our clients work through by figuring out a customized strategy and a system that helps eliminate poor decision making.

Starting the Year Off Right

So what should you be doing now in the new year? January is a great time to take a hard look at your spending and saving patterns from the past year to see how things can be improved.

No one can control what happens in the market but there are a couple of ways you can improve your net worth. The first is to make more money. Easy, right? The second way is to save more by spending less. Both are important but today we’ll focus on the latter.

The first step in saving more is to figure out where the money goes each month so you can stop the bleeding.

I’ve found that most people tend to underestimate or have no idea how much they spend each month. This is especially true if you have a monthly surplus because you are already living within your means and you aren’t facing financial ruin if you keep trekking along the same path.

There are a couple of approaches you can take to gain a true understanding of your monthly spend rate. The easiest approach is to rely on technology to do the heavy lifting for you. There are some great free or relatively inexpensive online budgeting tools that can bring transparency to your monthly spending.

Budgeting for the Non-Budgeter

If you really want to nerd out and take control of your money, you should check out You Need A Budget. Disclaimer: YNAB can be somewhat time consuming and cumbersome but it can really be a game changer if you invest the time in it. I have clients who swear by it.

A good middle of the road option is SimpliFi by Quicken. This will provide you with some really good insight into your spending as well as some nice budgeting tools.

You can also roll up your sleeves and figure out your monthly spending by logging into your credit card and bank accounts. Most major banks and credit card companies offer online spending reports. You can categorize all of your spendings and even look at the biggest purchases you made throughout the last year.

Marie Kondo Your Spending

Take a look at your recurring subscriptions. If there are any services that you no longer use, this is a great time to go online and cancel them. Use the Marie Kondo approach to your spending. What is really helpful or bringing joy to your life? These are the only things you should keep.

Don’t sweat the small stuff like feeding the daily coffee addiction. It’s the big items that are the killers. Do you need to take five expensive vacations each year? Are you actually using that fancy gym membership? Do you need eight different streaming services?

If you have a partner, this is a great time to have an open and honest conversation on where your money goes each month. This is all about bringing transparency to your spending patterns so that you can save and invest more money for a brighter future.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.