Are We in a Recession?

What is going on with the markets right now? The economy seems to be strong and recovering from the pandemic. Companies can’t hire enough workers, dinner reservations are hard to find, and traveling seems to be the most expensive it has ever been.

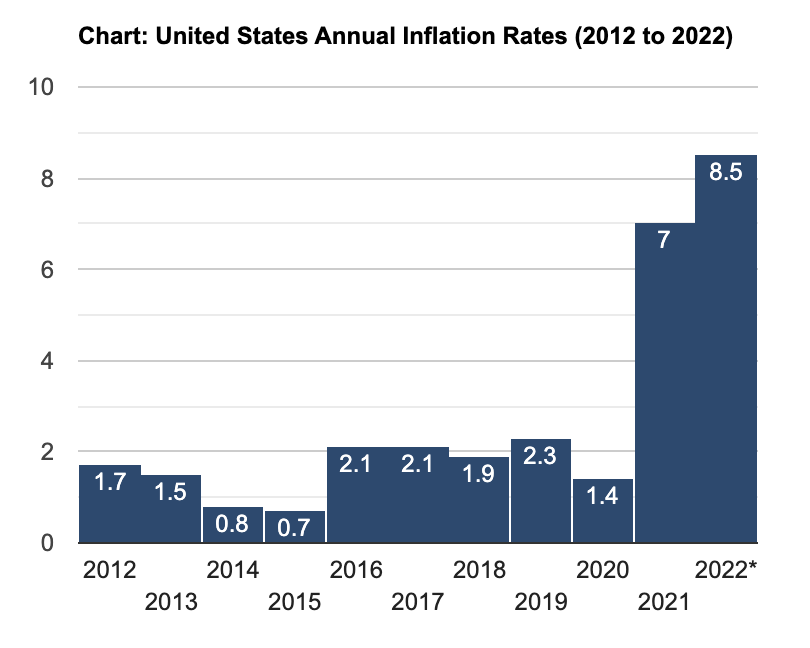

Unfortunately, inflation has been stubbornly high over the past year. The unprecedented stimulus spending, low interest rates, the Russian invasion of Ukraine, and major supply chain disruptions in China have all played a major role.

Inflation has been called the “invisible tax” because it quietly eats away at consumers’ purchasing power over time. Recently inflation has been running at 8.5%, which is much higher than the historical trend of 3%. As Warren Buffet recently said, “Inflation swindles everyone.”

The Federal Reserve Chair, Jerome Powell, has recently switched to a much more aggressive stance to get inflation under control. The main tool that the Fed has in curbing inflation is hiking up interest rates.

The Fed recently kicked off interest rate hikes with a quarter percent rate hike in the beginning of the year, followed by a half percent rate hike two weeks ago. The market has not responded kindly and has been violently selling off as a result.

Market Performance

The S&P 500 is now down about 17% year-to-date. The tech heavy Nasdaq and the small cap Russell 2000 are both already in a bear market as they are down almost 30% from market highs reached in November of 2021.

Some encouraging news is that over the past forty years, the S&P 500 has always been positive in the year following the first rate hike. Of course, this time could always be different since the Fed is starting well after inflation has already taken hold.

There are some promising signs that inflation may have peaked. The used car index started to subside in December of 2021 and oil prices have also been on a downward trajectory. Oil reached as high as $130/barrel and is now hovering around $110.

Bonds Don’t Like Rate Hikes

Shouldn’t the bond market be holding up when stocks are going down? This has been the case historically, but this past year has been the worst year for the bond market in decades.

The Wall Street Journal recently wrote an article titled “It’s the Worst Bond Market Since 1842. That’s the Good News.” The spike in interest rates has caused the aggregate bond market to lose 10% so far this year. This simply hasn’t happened before in our lifetimes. Even in the 1970s when interest rates were spiking, bonds held much steadier.

The reason is that the interest rate on the 10-year treasury has more than tripled in a short period of time, from 0.7% two years ago to 3% now. Interest rates and the price of bonds move in opposite directions. When yields jump, then the price of bonds will go down.

Will bonds continue to drop? We can’t know, but fortunately, the interest rate hikes are mostly priced into the market at this point unless inflation is actually much worse than what Wall Street believes.

Even though the performance in bonds has been suboptimal over the past year, it doesn’t mean that this trend will continue. In most cases bonds can still play an important role in diversifying and lowering volatility.

Are we in a recession?

There is a good chance that we may have already entered a recession. A recession is technically defined as two negative back-to-back quarters of GDP growth, so we won’t actually know if we are in one until the economic data from the 2nd quarter of 2022 comes out in July.

The initial estimate is that the US economy contracted by -1.4% in the first quarter of 2022, following the strongest year of economic growth in this century.

A recession doesn’t necessarily mean that we are headed for another leg down in the market. The market does a pretty good job of pricing things in six months in advance. Ironically, a lot of the volatility we are seeing right now could recede if we officially enter a recession since the Fed would likely take a more accommodative stance.

Remember the beginning of Covid? The stock market dropped by 35% in March and then rallied in April of 2020 when it was clear that we were heading for a recession. This was due to the unprecedented intervention by the Federal Reserve and the government in propping up the economy.

Recessions tend to be fairly deflationary, so the Fed might walk back some of the planned rate hikes if the economy goes off the rails. This could potentially be good for more innovative and growth-oriented stocks that thrive in lower interest rate environments.

So, what should you be doing with your portfolio right now? The best thing you can do is stick to your financial plan and keep a long-term perspective. It may even make sense to put some cash to work if you have the funds and the fortitude. Of course, this is easy in theory but difficult in practice because it feels like you are throwing away perfectly good money when investing in a down market.

Impact Fiduciary’s Point of View

My take is that we are likely in a shallow recession. We are starting to see some major demand destruction brought on by higher prices. The Fed was late to take away the punch bowl but may be over correcting now that inflation has arrived. However, Americans still have the highest savings on record and the jobless rate is at a historical low.

One thing I think we all learned over the past couple of years is that things can change very quickly. The reality around us is constantly shifting even though it’s easy to think that we will continue on the same trajectory.

I believe that sustainable investing is more important now than ever. It feels like we are at the crossroads of leaving behind a fossil fuel driven economy for greener pastures. The world is again being held hostage to the price of oil.

You may have noticed that the biggest drivers of inflation are gasoline, energy and electricity. Impact Fiduciary is proud to support companies that are solving the climate crisis by investing in the electric vehicle revolution, alternative energy and battery storage solutions.

Start SWEVing (Solar with Electric Vehicle)

You can personally protect yourself from inflation by ditching your gas car, going electric and installing solar panels on the roof of your house. You will receive a nice tax credit and the payback isn’t as long as you might think especially with energy costs surging. The cost of driving an electric car is about $10k less than the dinosaur juice burning alternative.

Of course, this isn’t an option for everyone, but it is a great way to save money, fight local pollution and lower your carbon footprint while supporting the companies leading the charge to a more sustainable economy.

In Closing

2022 has been a tough year all around. Everyone was hoping that this year would be a big care-free party after the pandemic ended. The war in Ukraine has been depressing while the markets haven’t been able to catch a break.

Here’s to hoping that our economy makes a big shift towards sustainable energy, Covid ceases to exist, the war in Ukraine ends, inflation subsides, and the Steelers new quarterback turns out to be the next Tom Brady.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.