Ukraine, Market Update and Investing in a Peaceful World

I’ve been glued to the news over the past week, watching in horror as Ukraine was invaded by Russian forces. It’s a depressing reminder that history still repeats itself and that humanity hasn’t outgrown its propensity to wage war.

The whole situation is heartbreaking, although it is truly inspiring to see the Ukrainian people take a stand and fight for their freedom.

As I’m sure you’ve seen, the conflict has added significant volatility to the global markets. Over the past week, we have seen huge daily swings in the major indices.

Market Performance

2022 has been a challenging year overall in the markets. The S&P 500 has been hovering in correction territory (down 10%) while the tech-heavy Nasdaq has been flirting with a bear market (20% decline) from its recent high.

Internationally, the MSCI developed markets and emerging markets indices are both negative for the year but performing slightly better than the US market. The question is what will happen now and what is really driving the recent performance.

The Global response

The US and its allies responded to the invasion by sanctioning Russia, cutting off banking and freezing Russian assets around the globe. Over the past weekend, the Russian currency plunged by 30% against the dollar due to these sanctions.

The Russian stock market has met a similar fate and is now down almost 60% year-to-date. Some reports claim there could be a run on the banks in Russia as citizens have been trying to get their cash out before a complete financial collapse.

The Russian economy is an emerging market and has a total output of about 1.5 trillion a year. Oil and gas are Russia’s main exports and account for 63% of its GDP.

Fortunately, Impact Fiduciary doesn’t have any direct exposure to Russia since it actively avoids autocratic countries with major human rights violations. I discuss this in more detail below.

The Russian economy is ranked 11th globally. To put this into perspective, the state of California alone is twice as large as the Russian economy with about 1/3rd of the population. However, Russia has the second largest military in the world, only overshadowed by the US.

The biggest consequence of the sanctions will be rising oil and gas prices across the world. Russia is a major player in the fossil fuel extraction business, and these markets are global, not local. This will likely result in more pain at the gas pump, which is just one more reason to go electric!

Source: www.fidelity.com

Geopolitical Conflict and the Markets

The good news is that the market tends to bounce back fairly quickly from armed conflict around the world. Of course, every new conflict is unique, so it’s always difficult to predict how things will play out.

According to a recent US News & World Report article, the S&P 500 has averaged a 5% decline following the 21 largest geopolitical events since 1941. A full recovery of these losses has only taken an average of 45 days from the market’s low point.

Interest Rates and the Fed

Inflation and higher interest rates have also been putting downward pressure on the price of stocks and bonds. The Federal Reserve’s main tool in fighting inflation is raising interest rates or the cost to borrow.

At this point, the market has fully priced in about 6 rate hikes this year. What does this mean? If you look at the bond market and the 10-year treasury, then it is already reflecting higher interest rates even though the Fed hasn’t actually raised rates yet.

One of the potential reasons that the market rallied last week is speculation that they won’t raise rates as aggressively due to the global conflict. The Fed may be more conservative in how they raise rates so they don’t tip the US into a recession.

Typically, the market is actually positive in years where the Fed starts to raise interest rates. If this holds true, then we could see a massive rally to the upside over the next few months.

According to Dow Jones Market Data, the S&P 500 has typically averaged a total return of 62.9% since 1989 during the period that the Fed has raised rates.

Sustainable Investing and Peace in the World

Impact Fiduciary is proud to focus exclusively on sustainable investment strategies. The goal is to provide great investment returns while investing in a portfolio that aligns with a more peaceful and better world.

The focus is on best in class companies and industries that take into account not only their stockholders but also their stakeholders, meaning the people who are impacted by the corporation’s actions.

Source: Fidelity

Impact Fiduciary is proud to use the Freedom Index fund as a way to get exposure to emerging markets while limiting countries led by oppressive regimes.

The fund is a passive index of the freest emerging market countries in the world. This means that it doesn’t invest in the biggest human rights offenders, such as China or Russia.

This divestment has paid off. Here is a chart of the Emerging Markets Index ETF (EEM) versus the Freedom Fund (FRDM). The Emerging Markets Index has a heavy weighting towards China and Russia and is down almost 12% over the past year while the Freedom fund is flat.

Transition to Renewable Energy

Impact Fiduciary has also actively avoided the fossil fuel energy sector while investing in companies actively trying to solve the climate crisis.

The main motivation is to stop contributing to climate change. However, the Russian invasion is another good reason why economies around the world should transition to renewable energy.

Autocratic countries tend to be reliant on exporting fossil fuels. I wrote about this almost 5 years ago: Five Reasons to Divest from Fossil Fuel Companies

Studies show a very strong correlation between government corruption and countries that are solely rich in resources, otherwise known as the “resource curse.”

By divesting from fossil fuels and transitioning the world to alternative energy, we can literally rip away power from dictators and oligarchs who steal their countries’ money for their own economic benefit.

What Now?

So what should you be doing with your investment portfolio amid all of the chaos? The best approach at this point is to stay the course or even consider buying into the market weakness.

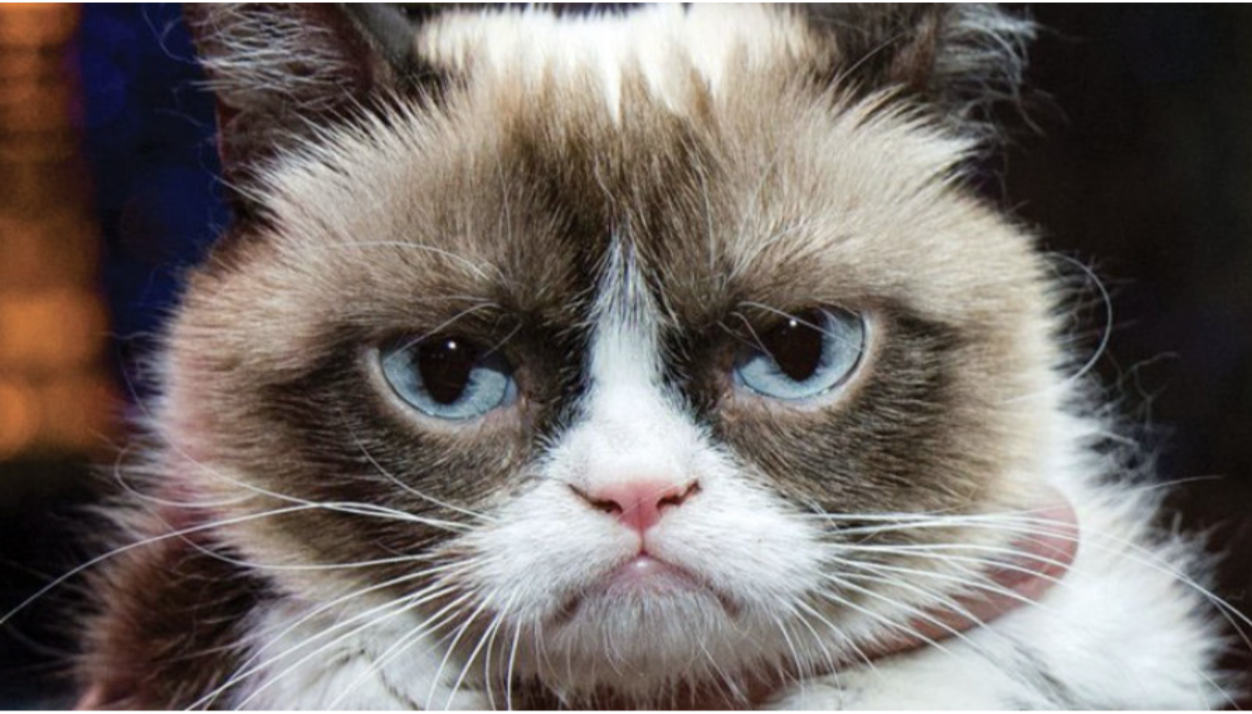

This is what it feel like to buy stocks during a market correction.

Historically, the best way to make money in the markets is to buy and hold for the long-run. However, you can increase returns by rebalancing your portfolio and by putting excess cash to work when there is a selloff.

The stock market is the only place where people like to buy high and sell low. The reason is that we tend to extrapolate current trends well into the future.

When we are facing hardship, our brains just aren’t wired to conceptualize things going back to normal even though history tells us it usually does.

In Closing

Over the past couple of weeks, I have been reflecting on how grateful I am to be living in a free and safe country.

One positive that could come from the Ukraine war and higher oil prices is that it may speed up our transition to a renewable future so we can live in a cleaner and more peaceful world.

Thanks for reading.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.