2020 Autumn Update

On November 8, 2016, my wife and I were living in the liberal bubble of San Francisco. The day before the election, we were very excited to learn that we were expecting our second child.

Emotions were running high during the day and it’s an understatement to say we were both shocked and disappointed by the outcome on election night. In fact, I think I’m still surprised even four years later.

As you can probably guess, I’m hoping for a Biden win next week for a myriad of reasons some of which I discuss below.

However, regardless of the outcome, I hope the country can mend fences and come together as a nation.

What About the Market?

Should we be worried about the stock market during this election? Should we take risk off the table or sell our stocks to see how things fare with our democracy?

What if we have a contested election? What if Trump refuses to leave after defeat?

The short answer is that I have no idea how things will play out. I’m optimistic that Biden will win, but it’s difficult to say, especially after the last election. This year has taught us that anything is possible, and no surprise would probably be the biggest surprise.

The market tends to do a good job of pricing in the risk of future events. It’s the events that no one sees coming that tend to hit the hardest: a terrorist attack, a meteorite heading for Earth, a devastating earthquake, a nuclear accident, or, as we’ve just seen, a pandemic that’s not taken seriously and spirals out of control.

The record short bear market in March is a good example of investors being caught flat-footed. In January and February, everyone had heard of COVID-19, but most people and Wall Street didn’t think it would have much of an impact on the US.

Of course, we were collectively wrong, as the country went into lockdown, and the market declined 37% from the all-time high reached in February.

Election Prediction

My prediction is that Biden will win and there won’t be any major news. I believe there is actually a good chance of the market rallying higher if this happens.

However, my crystal ball has been known to be wrong in the past. This is why diversification and risk management are so crucial when investing in the market.

Diversification is admitting that we can’t predict the future. Instead, we invest in different asset classes, which include stocks, bonds and alternatives that don’t always go up and down in tandem.

We periodically rebalance the portfolios by selling the areas that have performed well to buy into the areas that have fallen out of favor. This is the crux of portfolio management.

Do Presidents Matter?

Does the presidency really matter that much when it comes to the economy and the stock market? Fortunately, the global economy isn’t controlled by one person. We all love to pin the blame or praise on the president, but the reality is that they don’t have as much control over the economy or market as you might think.

Innovation, corporate earnings, consumer spending, inflation, interest rates, unemployment, and consumer confidence are just some of the variables driving the stock market forward or backward. It isn’t one person at the helm of the ship.

Think about it this way. If Trump had his way, oil would be trading at record prices, and we’d be building more coal plants. Instead, oil is tanking, and coal is on its way out.

There is no question that the president can have an impact on the economy, but it isn’t as profound as most believe. Raising or lowering taxes can make a difference in the short run, but so can government spending.

If you have a government that is raising taxes but simultaneously spending money on big infrastructure projects, then the higher taxes could potentially be offset or even turn out as a positive factor for the economy.

As of right now, the markets are pricing in a Biden victory in November. This would be great for a few areas of Impact Fiduciary’s managed portfolios.

Sustainable investing is at the heart of Impact Fiduciary’s investment strategies. This means avoiding certain areas of the market that have a negative societal impact, such as fossil fuel energy companies or private prisons, while embracing disruptive companies trying to solve some of humanity’s most vexing problems.

Biden’s Green New Deal

Biden plans to spend around two trillion dollars to combat climate change in his first term. Two trillion is a massive amount of money and will have a profound effect on the alternative energy companies and organizations on the front lines of fighting the climate crisis.

We desperately need these companies to thrive and displace our endless thirst for fossil fuels so that we don’t irreversibly destroy our planet. We are simply running out of time.

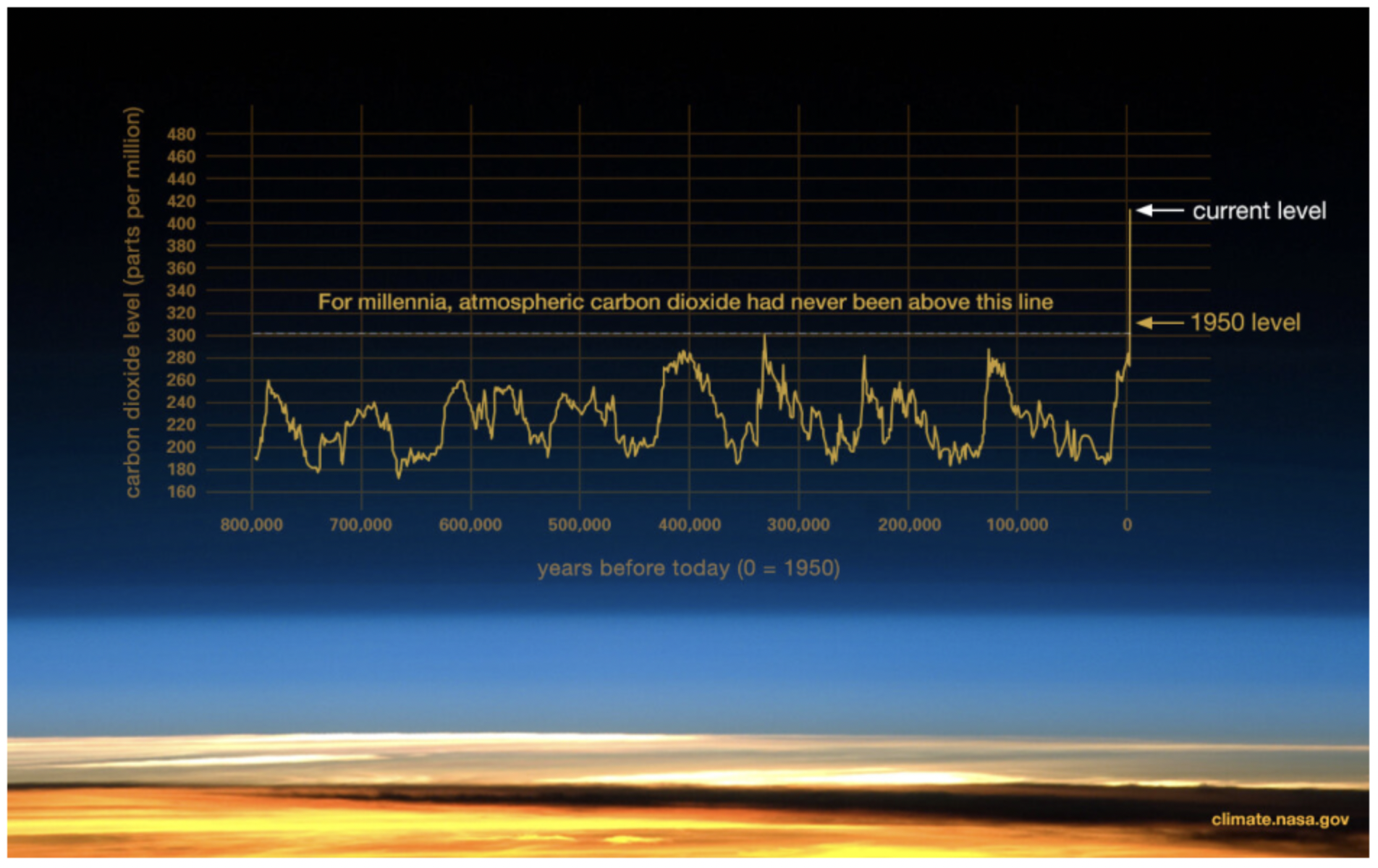

We need to lower our carbon dioxide output yesterday. Source: NASA

I’m proud to report that just over 15% of the equities in the Impact Fiduciary portfolios directly focus on solving climate change by electrifying the grid, moving from fossil fuels to solar, wind, and geothermal technologies, electrifying transportation, and even transitioning from factory farms to plant-based meat alternatives.

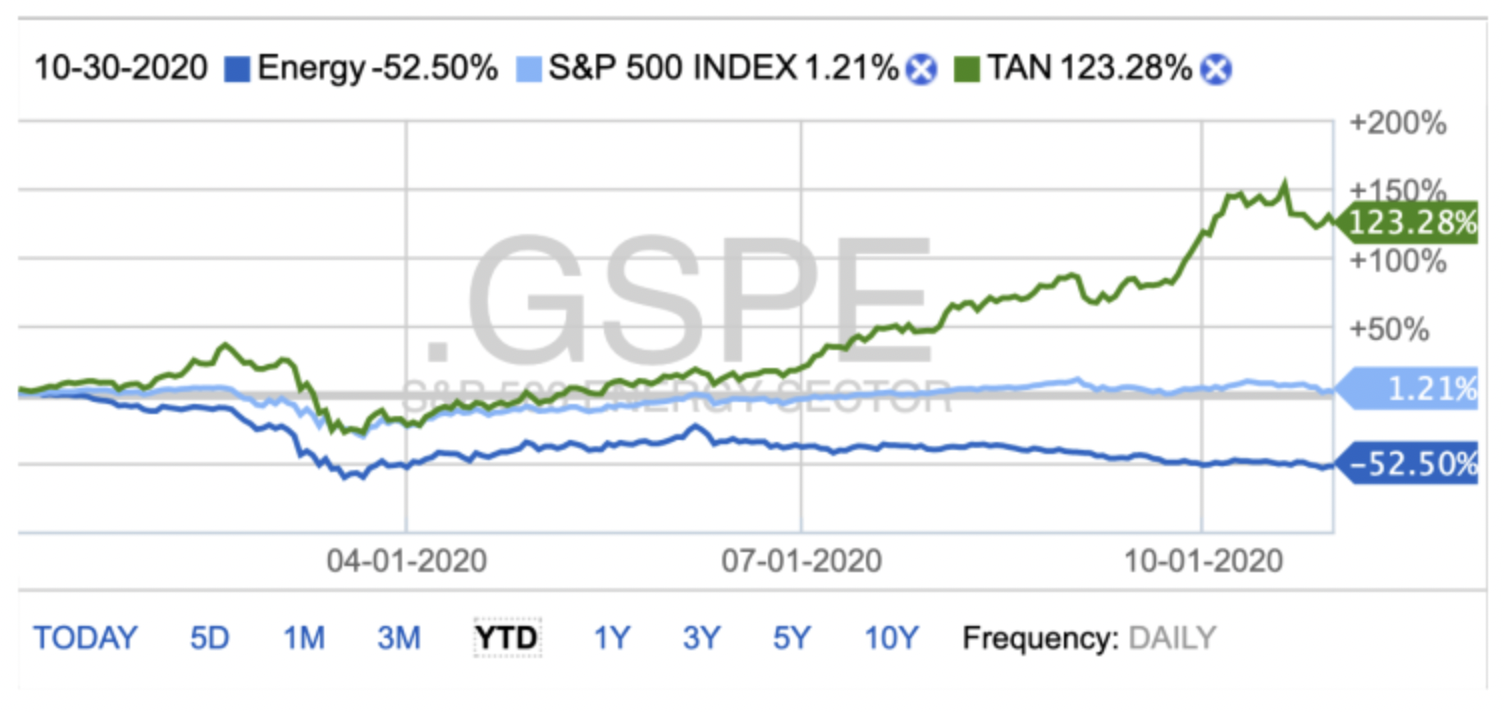

Comparison of the fossil fuel energy sector versus the Invesco Solar ETF Year to Date Performance (One of my favorite charts this year)

Source: Fidelity Investments

Biden’s capital and investment into these areas of the economy could dramatically speed up the transition to a carbon neutral economy and lessen the damage we are doing to Mother Earth.

Sustainable Real Estate Investing

According to the Environmental and Energy Institute, commercial real estate contributes a whopping 40% of carbon to the United State’s total output. Every Impact Fiduciary portfolio has some exposure to real estate in the form of publicly traded REITS.

One of the recent changes we made this past quarter is that instead of owning a REIT index fund, we have carved out a diversified portfolio of sustainable real estate to focus on lowering carbon output, mitigating risk and improving returns.

The new portfolio of REITs is designed to take advantage of the work-from-home trend that I believe is here to stay and avoid unnecessary risk in traditional commercial real estate holdings such as office buildings and long-term leases.

I believe the shoe has yet to drop in the commercial real estate market, so it makes sense to take cover by eliminating exposure to less climate friendly holdings that are the most prone to disruption.

I’m excited that our focus is now on some of the highest-rated ESG and sustainable REIT holdings available in the public markets. This includes exposure to infrastructure REITs such as cell towers, solar and wind farm leasing, and even logistical storage facilities for online retail companies.

Best of all this has dramatically cut down on the carbon output making it an even greener portfolio.

This year has truly been one for the books. I’m grateful to be able to serve such an amazing group of clients who really care about the environment and investing in a better world. The advice in the picture above is always relevant and especially in 2020!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.