Impact Fiduciary's Summer Update

2019 has been an exceptional year for the stock market! The market bounced hard from the 2018 lows and even broke new records in June. This has created fantastic returns for investors. Here are some fun facts:

The 30-stock DJIA and broad-based S&P 500 posted their best June in 81 and 64 years, respectively.

The DJIA delivered its best first half of the year since 1999.

The S&P 500 delivered its best first half since 1997.

The technology-laden NASDAQ recorded its best June in nearly 20 years.

Source: Financial Media Exchange

the Fed and trump

The biggest driver of market returns in June was the news of an almost certain Fed Funds rate cut in July. When the Federal Reserve cuts interest rates, it helps lower borrowing costs, which usually juices the economy and accelerates the price of assets such as real estate and stocks.

Low rates may seem great but can also cause massive inflation and unintended asset bubbles. Many economists have viewed low interest rates as a major driver of wealth inequality.

We are living in strange times, as the Fed usually lowers interest rates when we are clearly headed for a recession and the market needs to be stimulated. The last time the Fed started to cut rates was during the 2008 financial crisis. Banks were failing, the real estate market was imploding, and unemployment was skyrocketing.

In contrast, we are now in an economic era of record stock prices, expensive real estate, low unemployment, and strong GDP numbers. So why cut the rates now?

Not surprisingly, Trump has been publicly pressuring the president of the Federal Reserve to cut rates in order to further stimulate the economy right before the election year. Traditionally, the Fed has operated as an independent entity from any political party, but recently these lines have been blurred.

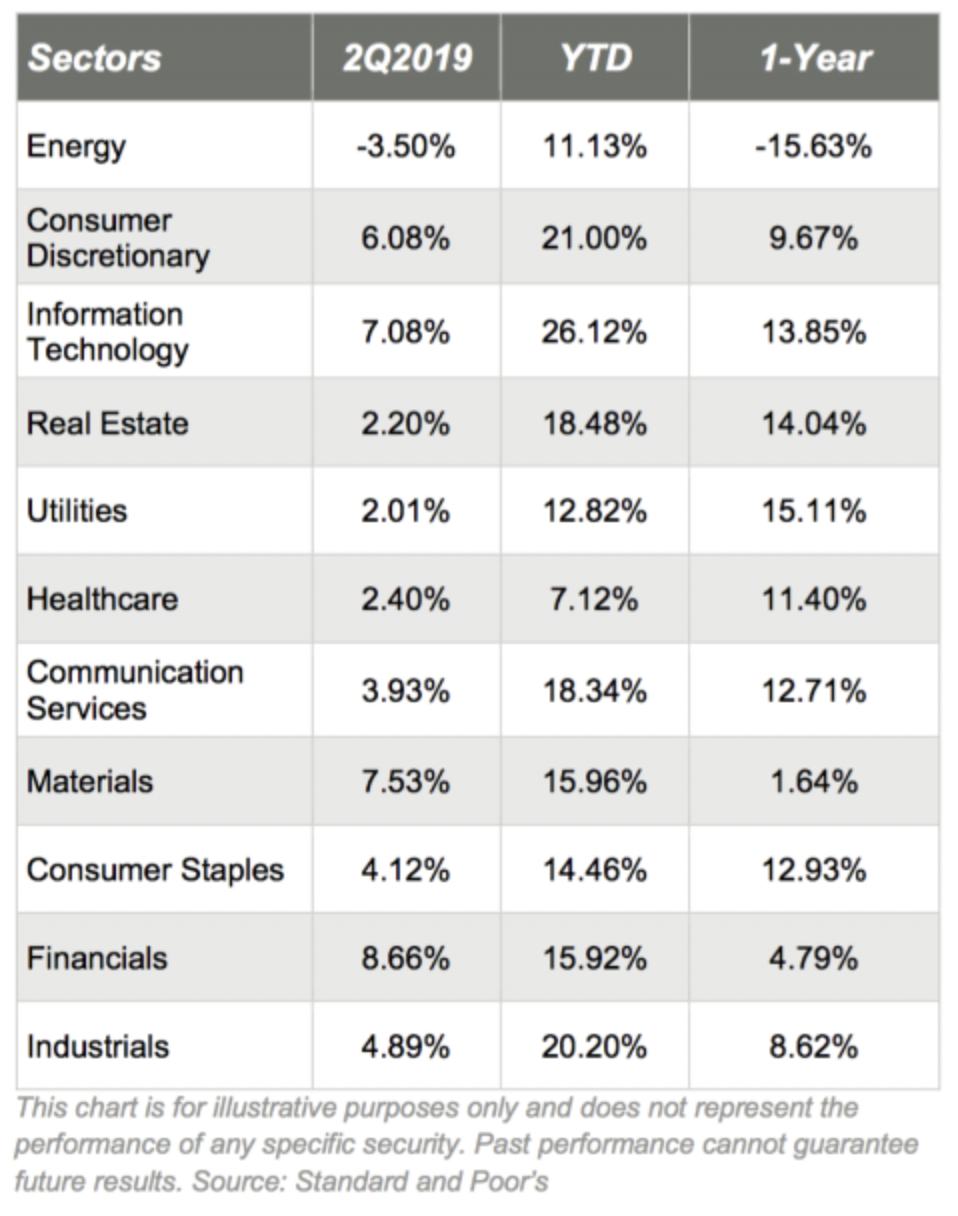

unsustainable Energy lagged behind

For the second quarter, 10 of the 11 S&P 500 sectors were up, with the fossil fuel energy sector lagging behind. Impact Fiduciary is proud to not have any exposure to the climate change–inducing sector. Not only is it bad our collective health, but the fossil fuel sector has also consistently dragged down performance over the past decade. I view investments in fossil fuel as a massive waste of money. You may as well just light your money on fire.

Green Investing = Win-Win

Impact Fiduciary’s managed portfolios enjoyed a great first half of the year. The companies and sectors focused on solving climate change outperformed as a group. Green investing really is a win-win, and not only helps the world but also can make money at the same time.

Sustainability Impact and a $53 trillion Opportunity

Unfortunately, as the market was breaking records, we also recorded the hottest June ever. It really is more important than ever to take aggressive action to curb global warming.

One of the best ways to solve the climate crisis is by transitioning to clean energy solutions while abandoning the dirty fossil fuel sector. Every dollar invested in clean energy provides support to the companies we desperately need to succeed. We simply are running out of time in our fight against climate change.

An upside is that in order to achieve these ambitious goals, we will need to invest massively in updating our current infrastructure. The International Energy Agency estimated that the world needs to invest up to $53 trillion in a green economy in order to meet the 2030 goal of limiting global warming by less than two degrees Celsius. This is a daunting amount of money needed but also represents a huge opportunity.

Local Action

This year I have made more of an effort to become active in my local community by working with the Glendale Environmental Coalition.

A major initiative this summer is opposing the expansion of the Grayson Gas plant. The Glendale city council will be voting on a new measure on July 23.

If you live in the LA area, I encourage you to make your voice heard in opposing the expansion. One simple thing you can do is write an email to the Glendale City Council explaining why we don’t need more pollution.

And if you have a minute please check out my recent op-ed that was featured in the LA Times – Glendale News Press: The time has come to say ‘no’ to Grayson plan and ‘yes’ to renewable energy

Thank you for your continued business and support!

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from Patrick Dinan, and all rights are reserved.